-

We areInfinite Growth BridgeCFD TRADING - FOREX TRADING - CONSULTATION - STOCKS TRADING

We areInfinite Growth BridgeCFD TRADING - FOREX TRADING - CONSULTATION - STOCKS TRADING -

The OptimalPlatformWith The World-Class Web Trading Platform

The OptimalPlatformWith The World-Class Web Trading Platform

Join our trading community now!

Infinite Growth Bridge Trade has grown massively, and now has over 5 million members and counting! The platform itself has also undergone some changes since 2018, and we are constantly working to ensure it is fast, accurate and easy to use. We have also refined our offering and introduced plenty of new products in our bid to continue giving our customers the ultimate online trading experience and to help them optimize their investment portfolio. Now, using our platform, our members can try CFDs on currency pairs, CFDs on stocks, CFDs on commodities, CFDs on cryptocurrencies, CFDs on ETFs, as well as Binary and Digital Options.

About Us

Infinite Growth Bridge Trade is one of the fastest growing online trading brands in the world, we offer CFDs on stocks and ETFs, Forex trading, and the exclusive Infinite Growth Bridge product called Digital Options.

The optimal platform for the Next Generation of Trading Platforms

Trading will never be the same again. Trade all of your favorite assets on an all-new, easy-to-use web-based trading platform that provides all the key data you need to perform market analysis like a pro.

Infinite Growth Bridge Trade’s mission is to make trading flexible

Our mission as an official partner of Bitcoin Foundation is to help you enter and better understand the world of #1 cryptocurrency and avoid any issues you may encounter.

We are here because we are passionate about open, transparent markets and aim to be a major driving force in widespread adoption, we are the first and the best in cryptocurrency.

Our Mission And Vision

We offer a wide range of services, designed to help trader invest their funds at great interest rate.

Starting Capital

The amount of starting capital depends on the market in which you plan to start trading. One of the unique advantages of the Forex market is that traders do not need huge amounts of capital to start, unlike stock markets.

money management

Professionals of exchange trading argue that success in financial markets depends primarily on the sound management of equity. Rules can be defined as the basic principles of trade, which must be strictly followed.

Risk must be conscious

RISK is necessary in small amounts, especially at the very beginning of your trading activity. Think soberly and prudently – if you are not confident in your abilities or have not thought through your further actions.

Trading Strategy

A trading strategy includes the development, monitoring, testing and adjustment of an action plan that is based on the personal preferences of financial market agents: profit objectives, risk attitude, choice of a trading asset.

Professionalism

Infinite Growth Bridge team are real pros in their field! Every year, our specialists undergo special training and testing to remain the best and not lose their qualifications.

Profitability

The effectiveness of your development and profits directly depends on you, but our team will help you do this as quickly and efficiently as possible, and most importantly, reduce risks and possible losses.

Terms & Conditions

1. Preface

1.1 This client agreement (the Agreement)is entered by and between Infinite Growth Bridge (the company) and the person and/or legal entity that has applied to open a trading account at the Company’s Binary Options trading platform (the Client), according to the terms and conditions detailed in this agreement.

1.2 Trading in Binary Options (Trading), means that a contract is being created which gives the Client the right to estimate the direction of change in price of an underlying asset, within a certain time frame determined by the Company. This trading instrument is different from trading in trading in options in a traditional way, since there is a fixed return that is determined at the outset of the trade, such as: there is usually no Stop-Loss order and other features.

2. The Trading Account

2.1 Account Opening Client may apply for an account through the Company’s website and the Company will accept such account opening application (the Trading Account) under the following terms: (i) the Company has received confirmation that the Client has agreed to enter into this Agreement (such confirmation can be made by checking the AGREE button or link on the Company’s Internet website (the Website), followed by a completed application form (if applicable) and all other Client’s information required by the Company to be provided. The Client confirms that Client’s information is full, accurate and complete. If there is a change in the information provided by the Client, the Client must notify the Company immediately of any such change.

2.2 Usage of the Trading Platform is done through the Account, by a limited license provided by the Company to the Client. The license is personal, non-transferable and is for persons who are older than 18 years old (or older legal age, if the law applicable to the Client’s jurisdictions requires a higher legal age) and subject to this Agreement. The Client will not transfer, assign, or enable other to make any use of the license, and/or give the Clients access codes to the Trading Account to anyone. Any damage caused to the Client, the Company and any third party due to breach of this Agreement by Client, shall be under the Client’s sole responsibility.

2.3 Activation of the Trading Account The Account will be activated by the Company as soon as the Company has identified the funds credited by the Client to the Trading Account. The Company may activate the Trading Account and permit trading in the Trading Account subject to such limitations, and to the satisfaction of such further requirements as the Company may impose. Where a Trading Account is not activated or is frozen, no funds held by the Company in respect of that Trading Account may be transferred back or to any other person until the Company is satisfied that all Applicable Regulations have been complied with.

2.4 The Company may act, according to the Company’s sole discretion, as principal or as agent on the Client’s behalf in relation to any Transaction entered into pursuant to the Agreement. Therefore the Company may act as the counter party to the Clients Trading activity. The Client confirms that it acts as the sole principal and not as agent or trustee on behalf of someone else.

2.5 The Client hereby represents and warrants that his engagement with the Company in this Agreement and his use of the Company’s services are in full compliance with the law applicable to the Client.

3. The Transactions

3.1 The Trading Platform enables Binary Options trading in exchange rates of different currencies, commodities, and any other financial instruments made available by the Company. The Trading Platform displays indicative quotes of exchange rates of different financial instruments pairs, based on different financial information systems, as the most updated exchange rates in the international capital markets. For determining the quotes for different time periods, the platform is making mathematical calculations according to known and accepted capital markets formulas. It is acknowledged by both Parties that due to different calculation methods and other circumstances, different trading platforms and/or markets may display different price quotes.

3.2 The Client will receive a predetermined pay-out if his binary option transaction expires in-the-money, and he will lose a predetermined amount of his investment in the Transaction if the option expires out-of-the-money. The predetermined amounts are a derivative of the collateral invested in the transaction by the Client, and will be published in the Trading Platform. The degree to which the option is in-the-money or out-of-the-money does not matter as it does with a traditional options

3.3 The Client authorizes the Company to rely and act on any order, request, instruction or other communication given or made (or purporting to be given or made) by the Client or any person authorized on the Client’s behalf, without further inquiry on the part of the Company as to the authenticity, genuineness authority or identity of the person giving or purporting to give such order, request, instruction or other communication. The Client will be responsible for and will be bound by all obligations entered into or assumed by the Company on behalf of the Client in consequence of or in connection with such orders, requests, instructions or other communication.

3.4 The Company reserves the right, but not obliged to the following: to set, at its absolute discretion, limits and/or parameters to control the Client’s ability to place orders or to restrict the terms on which a Transaction may be made. Such limits and/or parameters may be amended, increased, decreased, removed or added to by the Company.

3.5 Arbitrage/cancellation of orders and transactions. The Company does not allow actions or non-actions based on arbitrage calculations or other methods that are based on exploitation of different systems or platforms malfunction, delay, error etc. The Company is entitled, by its own discretion, to cancel any transaction that has been executed due or in connection with an error, system malfunction, breach of the Agreement by Client etc. The Company’s records will serve as decisive evidence to the correct quotes in the world capital markets and the wrong quotes given to the Client; The Company is entitled to correct or cancel any trade based according to the correct quotes.

3.6 Cancel Feature Abuse

Company offers a special cancellation feature that allows traders to cancel a trade within a few seconds of execution. Abuse of the cancellation feature can be considered market arbitrage and can result in forfeiture of profits. Company reserves the right to cancel a position if the cancellation feature is abused. The acceptable cancellation percentage cannot exceed 20% of the total number of executed trades. Cancelling more than 20% of the total number of executed trades is considered abuse of this feature and resulting profits may be forfeited from such abuse.

4. Margin

4.1 The Client may transfer funds to the Company with different methods of payment as permitted by the Company from time to time and in any currency (acceptable by the Company), and such funds will be converted and managed in the Trading Platform in US Dollars and/or Euro and/or GBP and/or CAD and/or AUD, as determined by the Company, according to an exchange rate determined by the Company’s according to the available market rates.

4.2 When making a bank transfer, the Client must send the Company an authentic SWIFT confirmation, stating full bank account details and proof that the bank account is registered under its name. Non-delivery of the SWIFT confirmation or in case that the details do not conform to the Client’s details registered at the Company may result in the funds not being credited to the Client’s Trading Account.

4.3 Whenever the Client transfers funds to the Company, those funds belong to the Company and will be treated by it as its own for the purpose of securing or covering the Client’s present, future, actual, contingent or prospective obligations, subject only to any contractual obligation of the Company to pay or return money to the Client according to the terms of this Agreement. The Client will not have a proprietary claim over money transferred to the Company, and the Company can deal with it in its own right. In determining the amount of collateral and the amount of the Company’s obligations to pay or return money to the Client, the Company may apply such methodology (including judgments as to the future movement of markets and values), as the Company considers appropriate.

4.4 The Funds deposited with the Company by the Client, together with any Profit or other Benefits the Client may be entitled to according to a specific agreement with the Company, shall be used as security to any Transaction, including Trading Losses, Commission and any other fee or debt owed by the Client to the Company, which will be automatically deducted from the Client’s equity in the Trading Account. The Client’s Funds shall not accumulate any interest or any other benefits. Trading in binary options that relate to a reference security shall not grant the Client any right to dividends, voting, allocations or any other Benefits, but may be subject to adjustments according to financial or corporate events which may have an effect the reference security, such as distribution of dividends, splits etc.

4.5 Repayment of any funds by the Company to the Client will be in the same currency and to the same account/credit card from which the funds were originally transferred, unless the Company has decided, by its own discretion, to return the funds to a different account of the Client.

4.6 The Client declares that all funds that it transfers to the Company do not derive from any criminal or other illegal activity and without any violation of any applicable anti money laundering laws and regulations.

4.7 The Client will have no claim against the Company and will not hold the Company responsible for any delay and/or differences originating from a credit company’s, banks or other financial institutions rates calculation and/or commission and/or any other debit.

4.8 Withdrawals In case the Client gives an instruction to withdraw funds from the Trading Account, the Company shall pay the specified amount (less any transfer charges, if applicable) once a duly instruction has been accepted and at the moment of payment, the Client’s margin requirements have been met. Withdrawal procedure takes 7 business days once Client’s documentation submitted and approved. The Company may cancel the Client’s withdrawal order, if, according to the Company’s discretion, the remaining funds (after the withdrawal) shall not be sufficient to secure open Position(s) in the Trading Account.

4.9 The Company shall debit the Client’s Trading Account for all payment charges. If the Client has the obligation to pay any amount to the Company which exceeds the amount held in the Client’s Trading Account, the Client shall immediately pay such amount upon Company’s request.

4.10 The Company shall not provide physical delivery in relation to any Transaction. As mentioned above, Profit or loss is credited to or debited to or from the Trading Account (as applicable) once the Transaction is closed.

4.11 A trading volume of deposit X 20 is required in order to make a withdrawal and also bonus amount X 50 to withdraw the Bonus.

5. Fees & Charges

5.1 The Company does not charge brokerage fees or commissions for executing trades.

5.2 The Company charges a fee for transfers of funds standing to the credit of a Trading Account from the Company to the Client, currently equivalent to 35 units per transfer.

5.3 The Company may levy an additional charge(s) on transfers of funds to be credited to a Trading Account made by debit card or credit card.

5.4 The Company may introduce additional fees and charges, and may change any existing fees and charges, at any time, by giving the Client not less than 10 Business Days notice of such changes.

6. Account Statements

6.1 Trading Account balances and statements are displayed within the trading platform made available to the Client by the Company. Common terms definitions can be found on the Company’s Website.

7. Bonuses

7.1 In order to withdraw your bonus you must first complete a turnover of bonus amount x50.

7.2 Company may offer the Client Bonus as Credit or tangible gifts, from time to time, at its sole discretion.

7.3 Bonuses and profits that are based, even partially, on use of bonus credit, shall be forfeited in case the Company suspects any act of fraud or breach of the Company’s Terms and Conditions by Client.

8. Privacy and Data Protection

8.1 The Company shall hold some personal client information due to the nature of the Company’s business and relations with the Client. All data collected, whether on paper (hard copy) or on a computer (soft copy) is safeguarded in order to maintain the Client privacy.

8.2 The Company shall be permitted to disclose and/or use the Client Information for the following purposes: (a) internal use, including with affiliated entities; (b) As permitted or required by law; (c) protection against or prevent actual or potential fraud or unauthorized transactions or behavior (d) computerized supervision of Client’s use of the services, review and/or supervision and/or development and/or maintenance of the quality of services; (e) to protect the Company’s rights or obligation to observe any applicable law.

8.3 The Client hereby grants his/her permission to the Company to make use of his/her details in order to provide updates and/or information and/or promotion or marketing purposes through the Clients E-mail address or other contact information. Cancellation of this consent shall be done in writing by providing written notice to the Company, and shall apply to new publications that have not been sent.

8.4 The Client agrees and acknowledges that the Company may record all conversations with the Client and monitor (and maintain a record of) all emails sent by or to the Company. All such records are the Company’s property and can be used by the Company, among other things, in the case of a dispute between the Company and the Client.

8.5 Affiliation- the Company may share commissions and charges with its associates, introducing brokers or other third parties (Affiliates), or receive remuneration from them in respect of contracts entered into by the Company. Such Affiliates of the Company may be disclosed with Client’s information.

8.6 The Company’s Trading Platform, Website or other services may require the use of Cookies.

9. Closing an account and cancellation of the agreement

9.1 Either party may terminate this Agreement by giving 10 (Ten) business days written notice by email to support@infinitegrowthbridge.com, of termination to the other party. Either party may terminate this Agreement immediately in any case of any breach of this Agreement or event of Default by the other Party. Upon terminating notice of this Agreement, Client shall be under the obligation to close all open positions, otherwise, the notice shall become void, or the Company shall have the right to close all open positions without assuming any responsibility. Such closer may result in outcome that would be less favorable for the Client.

9.2 Termination shall not affect any outstanding rights and obligations according to the applicable law and the provisions of this this Agreement.

9.3 Upon termination, all amounts payable by Either Party to the other Party will become immediately due.

10. Limitations of Liability and Indemnities

10.1 THE SERVICES OF THE COMPANY ARE PROVIDED AS IS AND AS AVAILABLE, AND COMPANY MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, WARRANTIES OF MERCHANT ABILITY AND FITNESS FOR PARTICULAR PURPOSE. THE COMPANY DOES NOT WARRANT THAT ANY AFFILIATED SOFTWARE, SERVICES OR COMMUNICATION THAT MAY BE OFFERED OR USED BY THE CLIENT SHALL ALWAYS BE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. THE COMPANY WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM TRADING OR THE USE OF THE COMPANY’S SERVICES, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.

10.2 Client acknowledges and agrees that the Trading Platform follows the relevant market, whether the Client is in front of his computer or not, and whether the Clients computer is switched on or not, and will exercises the order left by the Client if applicable.

10.3 The Client shall, upon first demand by the Company, compensate the Company from and against all liabilities, damages, losses and costs (including reasonable legal costs), duties, taxes, charges, commissions or other expenses incurred by the Company.

10.4 The Company shall have the right to set-off any amount owed by the Company to the Client, against any debt or other obligation of the Client towards the Company. In any event of Default of Client (voluntary or involuntary insolvency procedures against the Client) all debts, future debts and other obligations of the Client towards the Company shall become immediately due.

11. General Provisions

11.1 Amendments The Company has the right to amend the Agreement without obtaining any prior consent from the Client. If the Company makes any material change to the Agreement, it will give at least 10 (Ten) Business Days notice of such change to the Client. Such amendment will become effective on the date specified in the notice. Unless otherwise agreed, an amendment will not affect any outstanding order or Transaction or any legal rights or obligations which may already have arisen.

11.2 Partial invalidity- If, at any time, any provision of this Agreement is or becomes illegal, invalid or unenforceable in any respect under the law of any jurisdiction, neither the legality, validity or enforce ability of the remaining provisions of this Agreement nor the legality, validity or enforce ability of such provision under the law of any other jurisdiction shall in any way be affected or impaired.

11.3 Joint account- If the Trading Account is a joint account (on the name of more than one entity), then each of the entities in the Trading Account shall be authorized to represent the other entities towards the Company, with no requirement of any prior notice or approval from the other entities. Each of the entities in the Trading Account agrees that any notice or instruction given by the Company to any of the entities shall be considered as given to all the entities. In case of contradiction between instructions given to the Company by different entities, then the last instruction received by the Company will prevail.

11.4 Notices Unless otherwise agreed, all notices, instructions and other communications to be given by the Company shall be given to the address or fax number provided by the Client, or via e-mail or other electronic means, details of which are provided by the Client to the Company. Any complaint shall be directed to the Company’s client services department, who will investigate the complaint and make every effort to resolve it. Such a complaint should be made to: support@infinitegrowthbridge.com.

11.5 Governing Law These Terms and any relationship between the Company and the Client shall be governed by law applicable in America and subject to the exclusive jurisdiction of American courts. The Company shall have the right, in order to collect funds owed to the Company by Client or to protect the Company’s rights such as good-name, intellectual property, privacy etc. to immediately bring legal proceedings against the Client, in the Client’s residency and according to the Client’s residency applicable law.

11.6 No Right to Assign- No rights under this Agreement shall be assignable nor any duties assumed by another party except to/by an affiliate of The Company. Upon assignment to an Affiliate of the Company, the terms of this Agreement may be amended to fit any applicable regulation effective upon the assignee, and Client hereby consent in advance to such regulatory modifications to this Agreement. This Agreement shall be binding upon and inure to the benefit of the successors heirs of the Client.

11.7 Dormant Trading- If the Client will not perform any trading activity or his trading activity will be in very low volume, for the time period defined by the Company, or if the Client does not hold minimum funds in his Trading Account, defined by the Company, the Company may, charge the Trading Account with Dormant Trading commission, at a rate to be determined by the Company from time to time, close any open trade and/or the Client access to the Trading Account and/or terminate this Agreement.

11.8 Language, Notices and Complaints All communications between the Company and the Client will be in English or in any Language, suitable both to the Client and the Company.

11.9 Force majeure The Company shall not bear responsibility to any harm or any form which shall be caused to the Client in the event that such harm is the result of a force majeure and any outside event which is not in the control of the Company which influences Trading. The Company shall not bear any responsibility for any delay in communications and/or failure in the internet, including, without limitation, computer crashes or any other technical failure, whether caused by the telephone companies and various telecommunication lines, the ISP computers, the Company’s computers or the Customer’s Computers.

We wish you successful trading!

Strong Security

Protection against DDoS attacks,

full data encryption

World Coverage

Providing services in 99% countries

around all the globe

Payment Options

Popular methods: Visa, MasterCard,

bank transfer, cryptocurrency

Mobile App

Trading via our Mobile App, Available

in Play Store & App Store

Cost efficiency

Reasonable trading fees/commission for takers

and all market makers

High Liquidity

Fast access to high liquidity orderbook

for top currency pairs

Register

Open Account for free in just a few minutes

Verify your account

In accordance with Anti-Money Laundering regulations, to prevent potential fraud and ensure safety and reliability of clients' funds, Infinite Growth Bridge trade requests the following documents from its customers.

Make a deposit to your account

In order to start trading you should make a deposit. With Infinite Growth Bridge trade you can start with $100 minimum deposit!

The right solution for you

Trading costs down with competitive spreads, commissions and low margins.

+1 (305) 859-1251

Contact Us

Contact Us And Get Access To All Trading Services On Infinite Growth Bridge!

support@Infinite Growth Bridge.com

Latest blog post

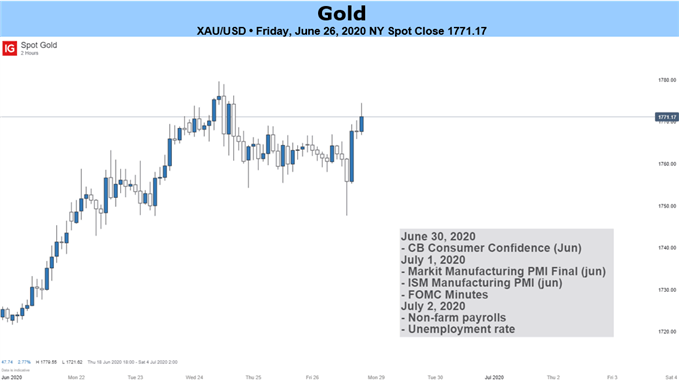

Gold prices have recently broken out above a key level at US$ 1,750 and edged higher. Global growth uncertainties resulting from the coronavirus and concerns over the economic recovery is inhibiting risk appetite and boosting demand for safety.

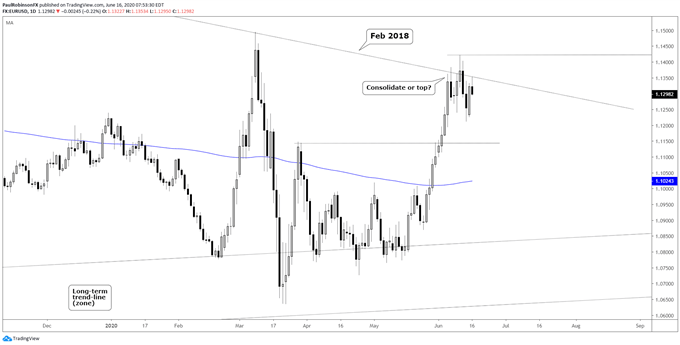

The EUR/USD rally since last month is at risk of failing, in-line with how it has behaved since early 2018. Rallies have been unable to hold for more than a week or so once they became extended. If price can maintain around trend-line resistance, then a change in character could be underway.

GBP/USD broke the sturdy March trend-line last week, and then retested the broken threshold. The sequence has price heading lower within the confines of a channel off the recent high. Looking lower, a break below 12335 will put Cable at risk of sinking towards the next area of support under 12200.

Login Your Account

Register here